SBFC Finance IPO Details

SBFC Finance IPO’s total issue size is Rs 1,025.00 Cr. The SBFC Finance IPO price is ₹54 to ₹57 per share. The IPO will list on BSE and NSE.

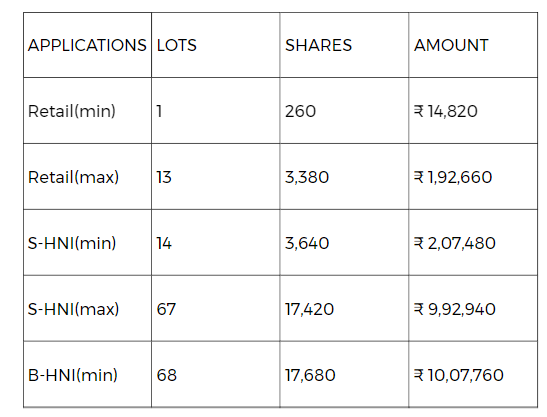

SBFC Finance IPO Lot Size

SBFC Finance IPO Reservation

SBFC Finance IPO a total of 179,889,948 shares are offered. QIB: 35,605,261 (19.79%), RII: 62,309,210 (34.64%), NII: 26,703,948 (14.84%).

Company’s Financials

Key Performance Indicator

SBFC Finance IPO Market Cap is Rs 6065.78 Cr and P/E (x) is 40.42.

The objective of this IPO

The Company proposes to utilize the Net Proceeds towards augmenting the Company’s capital base to meet their future capital requirements arising out of the growth of the business and assets.

Personal review for the IPO:

Disclaimer: I am not a financial advisor and for monetary reasons kindly consult your expert

The company’s Revenue yoy is on the rise so is its Profit resulting in almost doubling of the company’s worth in the span of 4 years.

I personally would be investing long-term in SBFC as a retail investor as per the current GMP the return on investment is certainly higher than the listing price. overall a good investment

SBFC Finance IPO Subscription Status (Bidding Detail)

The SBFC Finance IPO is subscribed 7.52 times on Aug 4, 2023. The public issue subscribed 5.26 times in the retail category, 7.09 times in the QIB category, and 13.70 times in the NII category.

GMP for company :

As of 6th august 17:00 the GMP of SBFC is ₹ 40

so the estimeted listing of company would be ₹ 97 so a 70.18% greater than the listing price